Markets

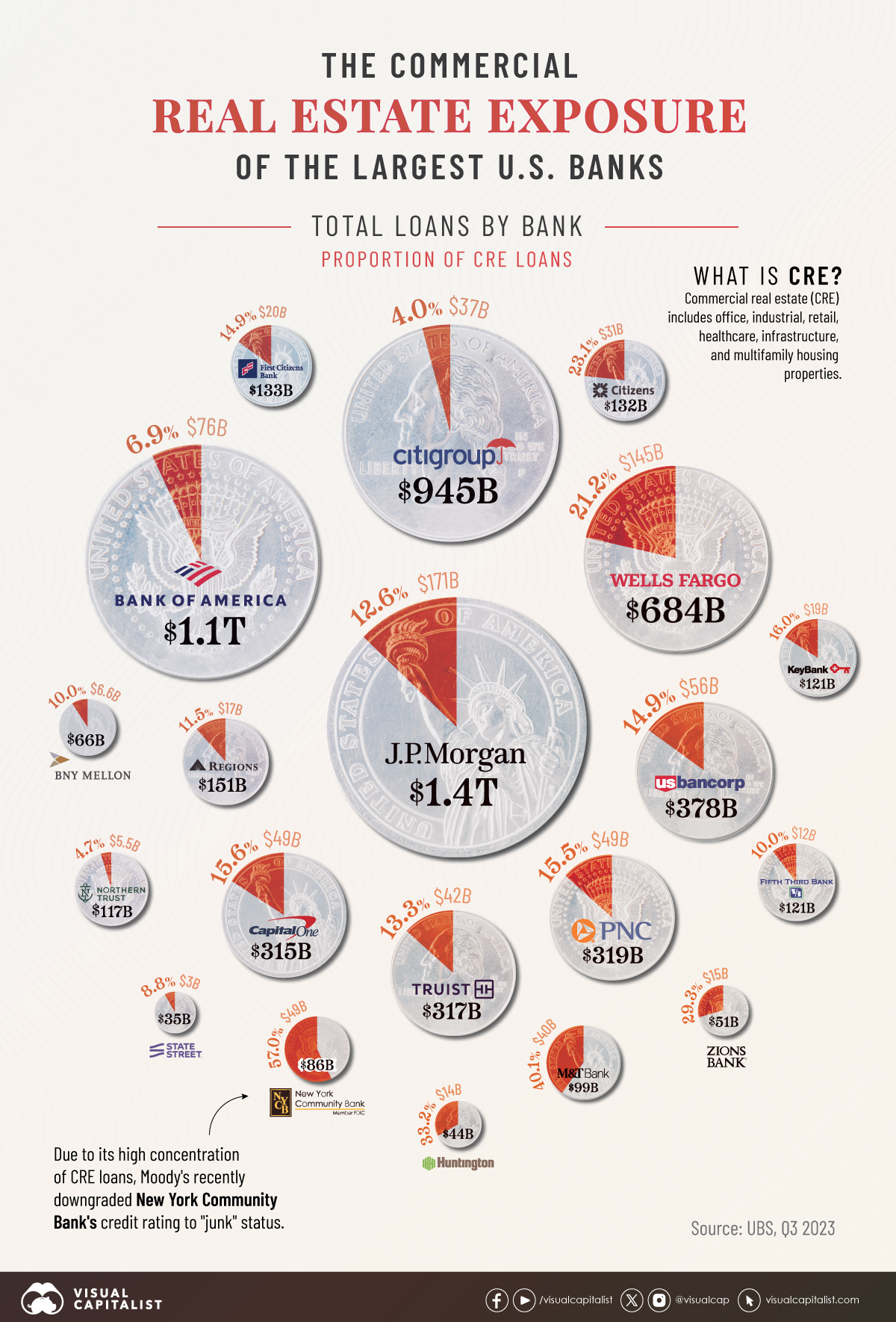

Visualizing Major U.S. Banks by Commercial Real Estate Exposure

![]() See this visualization first on the Voronoi app.

See this visualization first on the Voronoi app.

U.S. Banks by Commercial Real Estate Exposure

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

The six largest U.S. banks saw delinquent commercial property loans nearly triple to $9.3 billion in 2023 amid high vacancy rates and increasing borrowing costs.

Today, the sector is facing greater scrutiny from regulators amid growing risks to bank stability. In fact, for almost half of all U.S. banks, commercial real estate debt is the largest loan category overall. While commercial loans are more heavily concentrated in small U.S. banks, several major financial institutions have amassed significant commercial loan portfolios.

The above graphic shows the commercial real estate exposure of the top U.S. banks, based on data from UBS as of Q3 2023.

Top 20 U.S. Banks by Assets: Commercial Property Exposure

Here are the commercial property loans across the largest U.S. banks by assets as of the third quarter of 2023:

| Bank | Total Assets | Total Loans and Leases | Total Commercial Real Estate Loans | Share of Total Loans |

|---|---|---|---|---|

| JPMorgan Chase & Co. | $3.9T | $1.4T | $171B | 12.6% |

| Bank of America Corp | $3.2T | $1.1T | $76B | 6.9% |

| Citigroup Inc. | $2.2T | $945B | $37B | 4.0% |

| Wells Fargo & Company | $1.9T | $684B | $145B | 21.2% |

| U.S. Bancorp | $668B | $378B | $56B | 14.9% |

| PNC Financial Services Group, Inc. | $557B | $319B | $49B | 15.5% |

| Truist Financial Corporation | $543B | $317B | $42B | 13.3% |

| Capital One Financial Corp | $471B | $316B | $49B | 15.6% |

| Bank of New York Mellon Corp | $405B | $66B | $7B | 10.0% |

| State Street Corporation | $284B | $35B | $3B | 8.8% |

| Citizens Financial Group, Inc. | $226B | $132B | $31B | 23.1% |

| First Citizens BancShares, Inc. | $214B | $133B | $20B | 14.9% |

| Fifth Third Bancorp | $213B | $121B | $12B | 10.0% |

| M&T Bank Corporation | $209B | $99B | $40B | 40.1% |

| Keycorp | $188B | $121B | $19B | 16.0% |

| Huntington Bancshares Incorporated | $187B | $44B | $14B | 33.2% |

| Regions Financial Corporation | $154B | $151B | $17B | 11.5% |

| Northern Trust Corporation | $146B | $117B | $6B | 4.7% |

| New York Community Bancorp Inc | $111B | $86B | $49B | 57.0% |

| Zions Bancorporation, N.A. | $87B | $51B | $15B | 29.3% |

As the above table shows, JPMorgan Chase, America’s largest bank, has 12.6% of its loan portfolio in commercial real estate.

Despite commercial property troubles, the company witnessed record stock prices in 2023, with its share price increasing 27% over the year. The bank acquired First Republic at the height of the U.S. regional banking turmoil in 2023, which helped boost performance.

Still, big banks remain cautious. Several major banks, such as Wells Fargo, are building bigger cash reserves for commercial property credit losses as a buffer for potential defaults.

Perhaps the most concerning big bank is New York Community Bancorp, which has 57% of its total loans exposed to commercial property debt. The bank reported a $2.7 billion loss in the fourth quarter of 2023, and Moody’s recently downgraded its credit rating to “junk” status. The bank brought in a $1 billion infusion of capital as a lifeline after growing concerns about the state of its commercial real estate loan portfolio.

Overall, while pockets of trouble are surfacing, major banks are more insulated from commercial property shocks compared to other banks. On average, about 11% of big banks loan portfolios are concentrated in commercial real estate compared to small banks, where average exposure falls around 21.6% of loans.

Markets

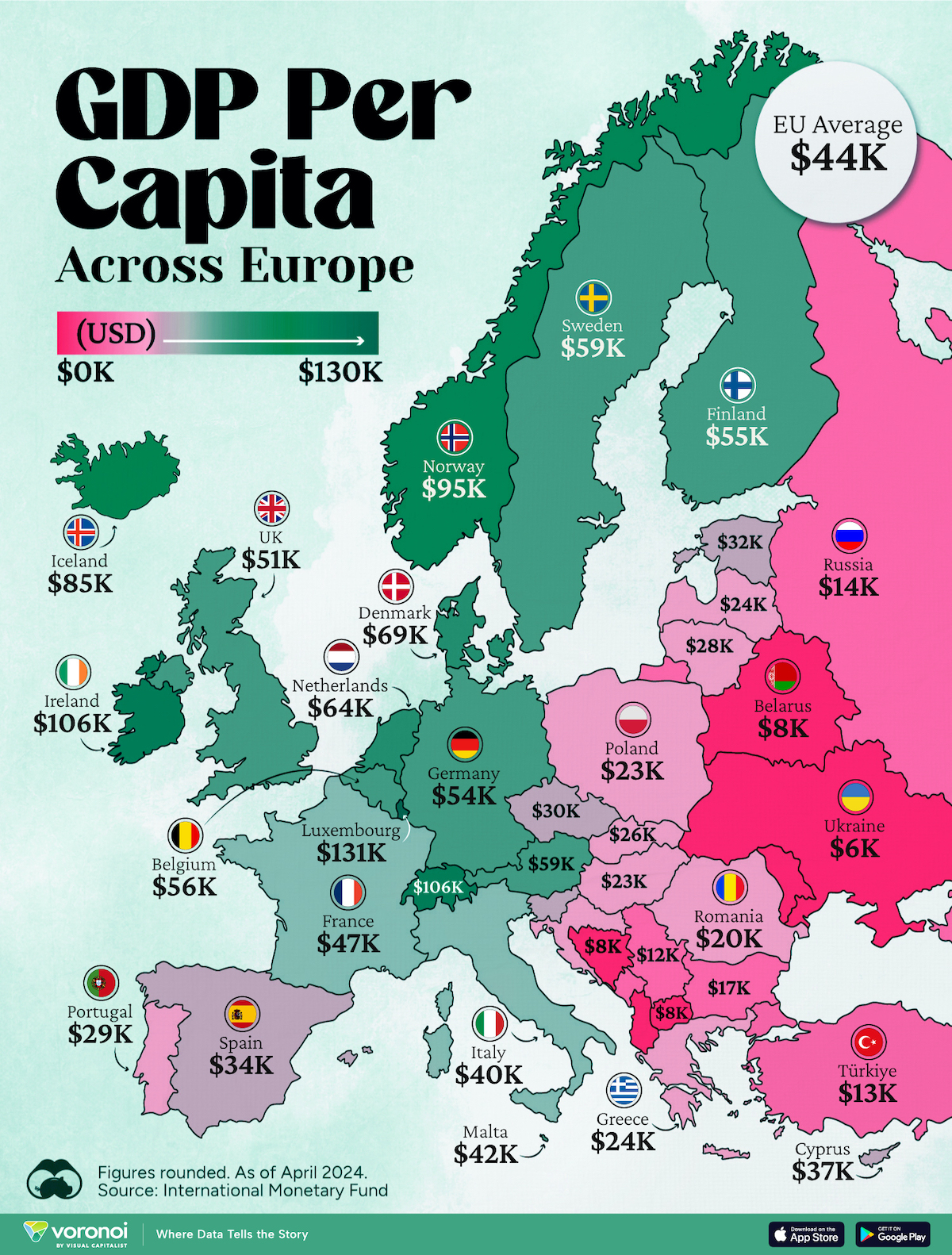

Mapped: Europe’s GDP Per Capita, by Country

Which European economies are richest on a GDP per capita basis? This map shows the results for 44 countries across the continent.

Mapped: Europe’s GDP Per Capita, by Country (2024)

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Europe is home to some of the largest and most sophisticated economies in the world. But how do countries in the region compare with each other on a per capita productivity basis?

In this map, we show Europe’s GDP per capita levels across 44 nations in current U.S. dollars. Data for this visualization and article is sourced from the International Monetary Fund (IMF) via their DataMapper tool, updated April 2024.

Europe’s Richest and Poorest Nations, By GDP Per Capita

Luxembourg, Ireland, and Switzerland, lead the list of Europe’s richest nations by GDP per capita, all above $100,000.

| Rank | Country | GDP Per Capita (2024) |

|---|---|---|

| 1 | 🇱🇺 Luxembourg | $131,380 |

| 2 | 🇮🇪 Ireland | $106,060 |

| 3 | 🇨🇭 Switzerland | $105,670 |

| 4 | 🇳🇴 Norway | $94,660 |

| 5 | 🇮🇸 Iceland | $84,590 |

| 6 | 🇩🇰 Denmark | $68,900 |

| 7 | 🇳🇱 Netherlands | $63,750 |

| 8 | 🇸🇲 San Marino | $59,410 |

| 9 | 🇦🇹 Austria | $59,230 |

| 10 | 🇸🇪 Sweden | $58,530 |

| 11 | 🇧🇪 Belgium | $55,540 |

| 12 | 🇫🇮 Finland | $55,130 |

| 13 | 🇩🇪 Germany | $54,290 |

| 14 | 🇬🇧 UK | $51,070 |

| 15 | 🇫🇷 France | $47,360 |

| 16 | 🇦🇩 Andorra | $44,900 |

| 17 | 🇲🇹 Malta | $41,740 |

| 18 | 🇮🇹 Italy | $39,580 |

| 19 | 🇨🇾 Cyprus | $37,150 |

| 20 | 🇪🇸 Spain | $34,050 |

| 21 | 🇸🇮 Slovenia | $34,030 |

| 22 | 🇪🇪 Estonia | $31,850 |

| 23 | 🇨🇿 Czech Republic | $29,800 |

| 24 | 🇵🇹 Portugal | $28,970 |

| 25 | 🇱🇹 Lithuania | $28,410 |

| 26 | 🇸🇰 Slovakia | $25,930 |

| 27 | 🇱🇻 Latvia | $24,190 |

| 28 | 🇬🇷 Greece | $23,970 |

| 29 | 🇭🇺 Hungary | $23,320 |

| 30 | 🇵🇱 Poland | $23,010 |

| 31 | 🇭🇷 Croatia | $22,970 |

| 32 | 🇷🇴 Romania | $19,530 |

| 33 | 🇧🇬 Bulgaria | $16,940 |

| 34 | 🇷🇺 Russia | $14,390 |

| 35 | 🇹🇷 Türkiye | $12,760 |

| 36 | 🇲🇪 Montenegro | $12,650 |

| 37 | 🇷🇸 Serbia | $12,380 |

| 38 | 🇦🇱 Albania | $8,920 |

| 39 | 🇧🇦 Bosnia & Herzegovina | $8,420 |

| 40 | 🇲🇰 North Macedonia | $7,690 |

| 41 | 🇧🇾 Belarus | $7,560 |

| 42 | 🇲🇩 Moldova | $7,490 |

| 43 | 🇽🇰 Kosovo | $6,390 |

| 44 | 🇺🇦 Ukraine | $5,660 |

| N/A | 🇪🇺 EU Average | $44,200 |

Note: Figures are rounded.

Three Nordic countries (Norway, Iceland, Denmark) also place highly, between $70,000-90,000. Other Nordic peers, Sweden and Finland rank just outside the top 10, between $55,000-60,000.

Meanwhile, Europe’s biggest economies in absolute terms, Germany, UK, and France, rank closer to the middle of the top 20, with GDP per capitas around $50,000.

Finally, at the end of the scale, Eastern Europe as a whole tends to have much lower per capita GDPs. In that group, Ukraine ranks last, at $5,660.

A Closer Look at Ukraine

For a broader comparison, Ukraine’s per capita GDP is similar to Iran ($5,310), El Salvador ($5,540), and Guatemala ($5,680).

According to experts, Ukraine’s economy has historically underperformed to expectations. After the fall of the Berlin Wall, the economy contracted for five straight years. Its transition to a Western, liberalized economic structure was overshadowed by widespread corruption, a limited taxpool, and few revenue sources.

Politically, its transformation from authoritarian regime to civil democracy has proved difficult, especially when it comes to institution building.

Finally, after the 2022 invasion of the country, Ukraine’s GDP contracted by 30% in a single year—the largest loss since independence. Large scale emigration—to the tune of six million refugees—is also playing a role.

Despite these challenges, the country’s economic growth has somewhat stabilized while fighting continues.

-

Markets5 days ago

Markets5 days agoVisualizing Global Inflation Forecasts (2024-2026)

-

Green2 weeks ago

Green2 weeks agoThe Carbon Footprint of Major Travel Methods

-

United States2 weeks ago

United States2 weeks agoVisualizing the Most Common Pets in the U.S.

-

Culture2 weeks ago

Culture2 weeks agoThe World’s Top Media Franchises by All-Time Revenue

-

voronoi1 week ago

voronoi1 week agoBest Visualizations of April on the Voronoi App

-

Wealth1 week ago

Wealth1 week agoCharted: Which Country Has the Most Billionaires in 2024?

-

Business1 week ago

Business1 week agoThe Top Private Equity Firms by Country

-

Markets1 week ago

Markets1 week agoThe Best U.S. Companies to Work for According to LinkedIn